Latest News

View our newest newsletter: https://www.prairiefoundation.com/download_file/view/210/249

If you would like to receive our quarterly newsletters directly in your inbox, please email our Operations Manager at aliciatjelmeland@crprairie.org.

Darrell and Dorothy Fisher Scholarships at Prairie High School

Darrell graduated from the first Prairie High School Class in 1959. Dorothy is a 1959 graduate of Marion High School. The Fishers did not have the opportunity to go to college but Darrell did take a DeVry Technical Institute course in Communication Electronics while in the US Air Force. Darrell has said “this, along with the great education I received at Prairie plus acquiring my Pilot’s Certificate just before I graduated from Prairie helped advance my career at Rockwell Collins".

The Fishers have created a scholarship fund at the Greater Cedar Rapids Community Foundation to benefit Prairie High and Marion High School Seniors. They see the scholarships as a stepping stone to a technical or college degree for deserving graduates.

Darrell and Dorothy were motivated to create the scholarships after returning to Prairie High School for Darrell’s 50 th Class Reunion. In 2013 they funded an account at the community foundation with an initial investment of $200,000. That initial investment has now surpassed their goal to grow this endowed fund to $1,000,000. Needless to say, students will benefit from the Fisher’s thoughtful generosity for years to come.

In 2024 the Fishers presented six scholarships in the amount of $2,900 each to graduating Prairie High School seniors to begin their post high school education at Kirkwood Community College. The Fishers make it a point to be on hand during the annual award night at Prairie to congratulate the scholarship recipients with a check, a hug and a group picture. The crowd loves to see the Fisher’s genuine interest and love for the students. Their generosity has been a motivating factor in the

establishment of additional scholarship and special funds.

Big Check Presentation 2024

This year, the Prairie School Foundation is pleased to present to Superintendent Doug Wheeler a check representing $87,000.00 that has been earmarked for the enhancement of the excellent educational opportunities here at Prairie.

The Foundation provides funding for essential items that are simply not available from the regular school budget. In addition, the Foundation administers twelve scholarships for graduating Prairie High school seniors.

The Foundation is only able to make these investments in Prairie Schools because people like you

support our annual Kids Fund drive and our events like Prairie Fest, and the Prairie Hawk Golf Challenge.

The Prairie School Foundation would like to sincerely thank the members of the Prairie Community for your generous support. Our mission is Collaborating for Sustained Excellence in Education.

And like you; We Are Prairie! Go Prairie Hawks!

Prairie School Foundation Mourns the Passing of Joyce Anderson

The Prairie School Foundation was formed in 1981 and Joyce's late husband, John, was a charter member of the board and served as its first President. Joyce also served as President of the foundation board in 1992. She was the recipient of the Pride of Prairie Award in 1987. The

award is presented annually by the Prairie School Foundation to recognize and show appreciation for individuals who exemplify the spirit of and a commitment to Prairie Schools.

Joyce volunteered for 53 years in the Prairie School system. Most of her time was spent at Prairie View where she worked in the library assisting children with learning in many ways, including being one of the first to teach children computer skills.

Joyce established the Reading is Forever endowed fund with the Prairie School Foundation in February of 2020. The primary purpose of the fund is to provide assistance to purchase books for all students K-4 who are unable to do so because of limited family financial resources. The

secondary purpose of the fund is to assist with purchasing warm clothing for ELL students who often arrive at Prairie from warmer climates. The Reading is Forever Fund balance is currently in excess of $80,000.

Joyce passed away on June 18th, 2024 in Cedar Rapids. Her commitment to Prairie Students will live in perpetuity through her Reading is Forever Fund.

Foundation Society Breakfast 2023

Our annual Foundation Society Breakfast was held on November 6th, 2023. While eating a delicious breakfast catered by LJ's Catering, Foundation Members and Donors enjoyed remarks by Superintendent Dr. Doug Wheeler, and Keynote Speaker Kenyon Murray. We also presented our annual Philanthropy and Pride of Prairie Awards. For more details on the Award Winners and Speakers, see our Facebook Page!

The Winners of this years Philanthropy Awards:

- Holmes Murphy

- Debbie Erenberger

Pride of Prairie Award Winner:

- Scott Slezak

Ying Ying Chen Educator IMPACT Award Presentation

The family of the late Ying Ying Chen announced the establishment of the Ying Ying Chen Educator IMPACT Award in 2021 to honor the memory and distinguished career of Ying at Prairie. She served as an elementary school Principal and later as a District Administrator.

The award recognizes an educator who embodies Ying’s passion for learning and commitment to students, staff, and colleagues. The recipient of the award receives a $1,000 stipend to support an educational project.

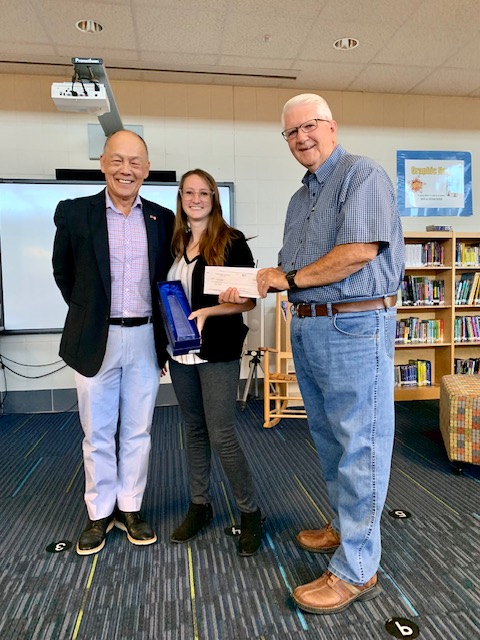

The three finalists for the 2022 IMPACT Award included: Allison Gates a teacher/librarian at Creek; Joint applicants, Kim Heckart and Becky Sorg teachers at Ridge and Kristen Jennerjohn a special education teacher at Hill.

The winner of this year’s award was Kristen Jennerjohn. Kristen is a Special Education Teacher at Prairie Hill Elementary. Her students include those who are completely non-speaking, others who struggle to express their thoughts and others who don’t easily understand what is being said. Kristen plans to use her award to purchase TouchChat with Word Power a Peer to Peer communication system to enhance communication between her students, their teachers and

peers.

Past Articles:

PSF Director's Visit to Prairie Delta 2019

PSF Supports a New Endeavor 2019

Allocations Committee Meets 2019

Prairie School Foundation Presents a Big Check 2019

Music to Our Ears 2018-2019

Gifts of appreciated Stock. A way to benefit while doing good.

Prairie Agriculture Education and FFA Kick Off Event

Zio Johno's Fundraiser is a Success

Events

Links

Contact

Prairie School Foundation

401 76th Avenue SW

Cedar Rapids, IA 52404-7034

Phone: (319) 848-5200 Ext. 2019